2017 JA Youth And Financial Literacy Survey

Junior Achievement USA is pleased to provide this summary of the 2017 Youth & Financial Literacy. The survey included 500 children between the ages of seven-to-10 and their parents, resulting in 500 responses from children and 500 responses from parents.

The survey was conducted through an email invitation and an online survey between March 21 and March 27, 2017. The focus of this survey included how children earn their allowance, how children perceive money earned, as well as insights to when parents think children should start learning about personal finances.

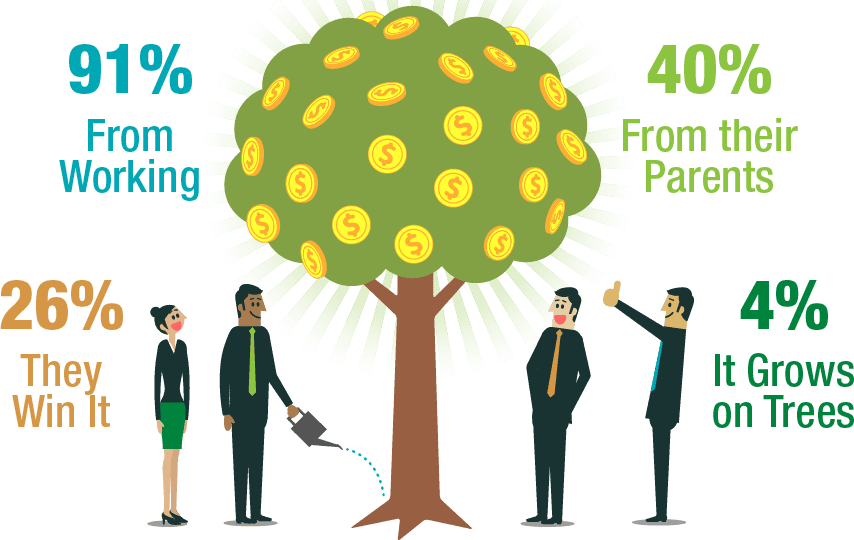

Hard Work Pays Off

The majority of the 500 children who responded had accurate expectations of how money is earned. In all, 91% believed people earn money by working, 40% thought money came from parents, 26% thought money was earned (by means other than working), while 4% believed money grew on trees.

How do people get their money?91% from working, 40% from their parents, 26% they win it, 4% it grows on trees.

Hands-On Experience

The majority of the kids had hands-on experience with earning their own money at home. Of the 500 students, 82% of the children stated that they earned an allowance for doing chores, getting good grades, doing homework and simply being kind to others at school and at home. Through this hands-on approach, most of the children in this study were knowledgeable about the basics of money, including how to count and save money.

How do you get your allowance?

68% Do Chores, 54% Get Good Grades, 36% Do My Home Work, 21% Be Nice To Parent /Siblings

Achieving Financial Freedom Starts In the Home

When it comes down to parents’ expectations of their children and finances, 94% of parents believed that by the age of 12 a child should start learning about personal finances. While the majority of parents (92%) are leading by example by saving money for emergencies, college tuition, and retirement; many children still seem to lack the understanding of savings, interest and smart spending.

At what age should people start learning about personal finances?

67% 5-to-8-years old

27% 9-12-years old

5% 13-to-20-years old

Methodology

The Junior Achievement-Jackson Financial Literacy Surveys were conducted by Wakefield Research (www.wakefieldresearch.com) among 500 U.S. children ages 7-10 and 500 parents of U.S. children ages 7-10, between March 21 and March 27, 2017, using an email invitation and an online survey.

Results of any sample are subject to sampling variation. The magnitude of the variation is measurable and is affected by the number of interviews and the level of the percentages expressing the results. For the interviews conducted in this particular study, the chances are 95 in 100 that a survey result does not vary, plus or minus, by more than 4.4 percentage points in each audience from the result that would be obtained if interviews had been conducted with all persons in the universe represented by the sample.